Building Beneficial Wealth, Together

Tailored Strategies to Preserve, Grow, and Simplify Your Wealth

Clarity. Confidence. Control.

At Beneficial Wealth, our mission is simple: to help you keep more of what you’ve earned, grow your wealth efficiently, and stress less about the future. We provide personalized, tax-focused planning with clarity and care to simplify your wealth – always putting your peace of mind first, so you can move forward with confidence and control in every financial decision. Everyone deserves to enjoy retirement on their terms, with the freedom to protect and grow what they’ve earned, and the confidence to go do that thing they’ve always dreamed of – and we’re here to help make it possible.

A coordinated, holistic wealth plan to help grow and protect your wealth.

Protect and Preserve Investable Assets

Build a holistic financial plan that addresses six fundamental financial planning considerations.

Look to Optimize Total Return Potential

Deploy customized investment and tax strategies for growing and shielding your assets.

Remain Committed to the Strategy

Be confident in and committed to your plan with strategies that are in your best interest.

The Beneficial Blueprint™

Utilizing our BIG bucket framework so you can go do that thing

Bucket 1

BANK

Safe, Ready, & Reliable Money

Cash on Hand

Bucket 2

INCOME

Income you can count on

Your 10 Year Paycheck

Bucket 3

GROWTH

Long Term Market Growth

Invested for the Years & Generations Ahead

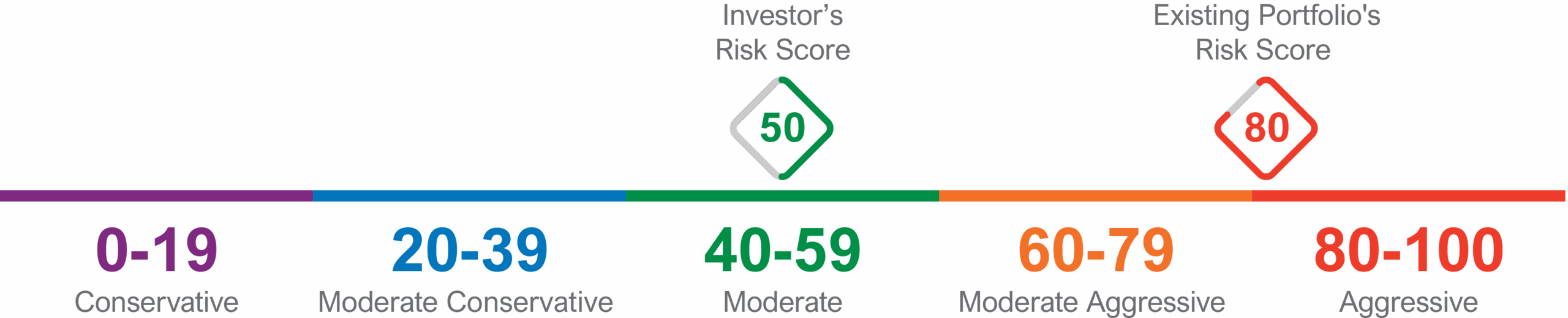

What’s a Risk Score?

Risk tolerance is an investor’s ability to remain invested during downward market cycles in exchange for a potential return.

It’s important that investors understand their risk tolerance so that they can help guide the design of their investment strategy. This approach looks to balance the investor’s desire for returns goals with their ability to stay confident and invested throughout market cycles.

To help investors understand their risk threshold we deploy a proprietary algorithm rooted in the well-known Value at Risk (VaR) measurement that helps us quantify their sentiment toward financial uncertainty, specifically their emotional tolerance with respect to the magnitude and speed of potential investment loss. This Analysis provides them with a VaR Score that can help determine if their existing portfolio aligns with their risk tolerance.

Intelligent, Disciplined Investing with AssetLock

AssetLock is a proprietary, investment portfolio monitoring service that delivers personalized communications to advisors and investors in a secure environment.

This technology informs investors about their portfolio’s progression according to their risk tolerance

AssetLock® is tracking software used to monitor the performance of a client’s household portfolio and predetermine the amount of downside the client is willing to tolerate. The AssetLock Threshold is the maximum percentage of the downside the investor is willing to accept inside the portfolio as determined by Simplicity’s proprietary risk scoring algorithm, which is based on a Risk Tolerance Questionnaire and Value at Risk (VaR) Analysis of the household and model portfolio(s). It is NOT an actual stop order and will NOT automatically sell the individual securities in the household portfolio. The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Retirement Resources

Important Birthdays Over 50

Retirement comes with a timeline, and missing key milestones could mean missed benefits or surprise penalties. This guide walks you through important birthdays after 50, from catch-up contributions to Medicare and RMDs, so you can do more to stay ahead and make the most of opportunities. Retirement should be celebrating these birthdays, not regretting them.